Credit Scores Unions: Your Entrance to Financial Well-Being

Lending institution have arised as a vital channel to economic stability, providing a host of benefits that traditional banks may not give. From customized focus to affordable prices, they deal with the private requirements of their members, fostering a sense of area and trust fund that is commonly doing not have in bigger banks. The concern continues to be: just how do lending institution achieve this distinct balance of individualized solution and economic advantages, and what establishes them apart in the world of economic well-being?

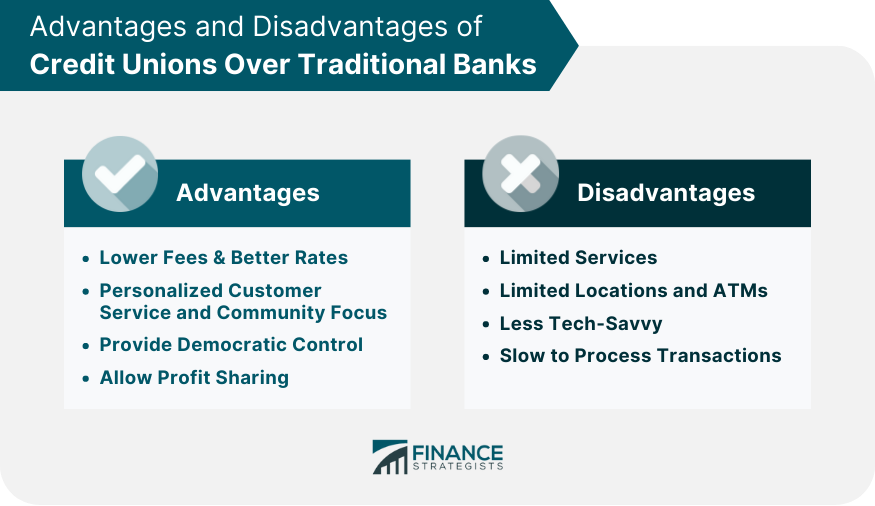

Benefits of Joining a Cooperative Credit Union

Furthermore, by signing up with a credit score union, individuals come to be component of an area that shares similar economic goals and values. By lining up with a credit scores union, people not just enhance their very own economic well-being however likewise contribute to the economic development and prosperity of their neighborhood.

Personalized Financial Solutions

When looking for customized economic services, participants of lending institution can benefit from customized guidance and solutions created to fulfill their one-of-a-kind demands and objectives. Credit history unions prioritize recognizing their members' financial situations, objectives, and restraints to supply customized solutions that conventional banks may not provide. This individualized technique permits credit report union participants to access a range of financial services and products that provide particularly to their private situations.

Credit history unions provide personalized financial remedies such as customized budgeting plans, financial investment techniques, and financing choices customized to members' credit score scores and financial backgrounds. By functioning very closely with their members, credit score unions can offer recommendations on just how to boost credit report ratings, conserve for details goals, or navigate monetary obstacles.

Reduced Costs and Competitive Rates

In the world of economic solutions, lending institution establish themselves apart by supplying participants reduced fees and competitive rates compared to conventional banking organizations. Among the crucial benefits of lending institution is their not-for-profit structure, which enables them to focus on the financial health of their participants over maximizing profits. As a result, lending institution can use reduced charges on services such as checking accounts, savings accounts, and car loans. This cost structure can cause substantial expense savings for members in time, particularly when compared to the fee schedules of several typical financial institutions.

Furthermore, credit rating unions often give a lot more affordable rates of interest on savings accounts, deposit slips, and fundings. By maintaining lower operating expense and concentrating on offering their members, debt unions can pass on the advantages in the kind of greater rates of interest on financial savings and lower rate of interest on finances. This can aid members expand their savings quicker and pay much less in passion when obtaining cash, ultimately contributing to their general monetary wellness.

Area Emphasis and Client Service

With a solid focus on area emphasis look at this now and phenomenal customer service, credit score unions identify themselves in the financial solutions sector. Unlike traditional banks, credit history unions prioritize developing strong relationships within the communities they serve. This community-centric strategy permits cooperative credit union to better recognize the one-of-a-kind economic demands of their members and tailor their solutions as necessary.

Client service is a top concern for lending institution, as they make every effort to supply individualized support to each participant. By using a much more human-centered approach to financial, lending institution produce a welcoming and encouraging setting for their members. Whether it's assisting a member with a loan application or providing economic recommendations, cooperative credit union personnel are known for their conscientious and caring service.

Getting Financial Goals

One method lending institution sustain participants in accomplishing their financial goals is by supplying economic education and learning and resources. Through workshops, workshops, and individually examinations, cooperative credit union team supply important insights on budgeting, conserving, investing, and managing financial debt. By gearing up participants with the needed understanding and skills, lending institution equip people to make enlightened financial choices that line up with their goals.

Additionally, lending institution supply a wide variety of financial product or services to aid members reach their particular purposes. Whether it's obtaining a home mortgage, establishing up a retirement account, or beginning an university fund, cooperative credit union supply customized services that accommodate members' one-of-a-kind needs. By functioning closely with each participant, credit score unions guarantee that the economic services and products suggested remain in line with their lasting and short-term monetary objectives.

Verdict

In final thought, cooperative credit union use a gateway to monetary health through personalized focus, tailored monetary site here options, reduced costs, and competitive rates. As member-owned cooperatives, they prioritize the demands of their participants and give better rates of interest on interest-bearing accounts and reduced car loan rates - Credit Union Cheyenne. With an area emphasis and dedication to customer support, cooperative credit union make every effort to recognize their participants' one-of-a-kind economic scenarios and objectives, using individualized advice and assistance to aid people attain their economic purposes

In addition, credit unions frequently offer monetary education and counseling to assist participants enhance their monetary literacy and make better choices concerning their cash administration.

Credit score unions use customized financial solutions such as tailored budgeting strategies, investment strategies, and loan alternatives tailored to participants' debt ratings and financial backgrounds. Wyoming Credit Unions.One means credit score unions support members in accomplishing their financial objectives is by providing economic education and sources. By working carefully with each member, credit score unions ensure that the monetary items and services suggested are in line with their long-term and temporary economic goals

With an area focus and dedication to customer solution, credit history unions strive to comprehend their participants' distinct economic situations and goals, supplying customized support and support to help people attain their financial goals.